Understanding the Omnichannel Motorcycle Gear Shopper

Background

The state of motorcycle-related brick-and-mortar stores is looking grim in 2019. Not only is the consumer shift to online shopping placing major pressure on marketplace retailers, but motorcycle registrations are steadily declining, decreasing the pool of enthusiastic riders looking to gear up. Outside of consumer trends, motorcycle gear stores have gotten left in the dust as retailers with deeper pockets and larger market shares innovate and improve upon their real estate, merchandising, and experiential store models. What’s left for motorcycle gear shoppers are stores that are cluttered, unappealing, lacking in omnichannel features, and starkly contrasted to the ‘endless aisle’ of their favorite online marketplaces like Amazon.

Opportunity

With 140+ brick and mortar stores, RevZilla’s sister company wanted to better understand why customers visited their stores. They wanted to understand what was important to shoppers, and how satisfied shoppers were with the most important aspects of their shopping experience. They also wanted to better understand the different types of shoppers, and if omnichannel shoppers were having different experiences and expecting different things compared to in-store only shoppers. This research also needed to sync with several other projects occurring at the same, including a third-party branding project and exploration into new store designs.

How might we create a retail experience that fits our customers’ unique unmet needs?

Methods

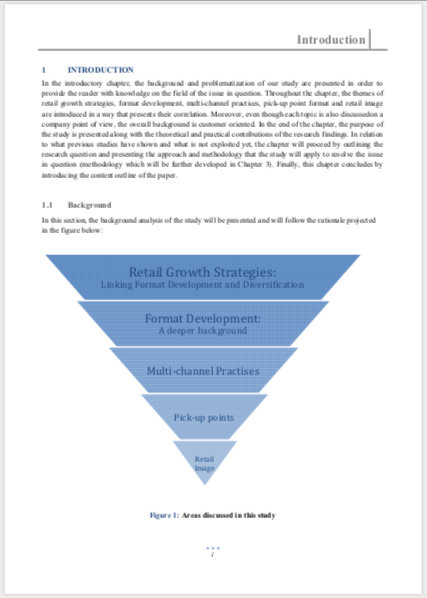

Literature Review

When I began work on this project, one of the biggest “risks” I identified was my own lack of knowledge about the in-store, brick-and-mortar retail experience, and how it differed from online shopping. A confident UX researcher with practice testing a variety of different online shopping patterns, I quickly realized my gap in physical store knowledge would hold me back in the research process, from drafting specific interview protocols to crafting thorough surveys. I dove into as much academic and industry research I could find. One of the best outcomes of this process was crafting and successfully pitching a plan for in-store observation and in situ customer interviews.

Store Observation

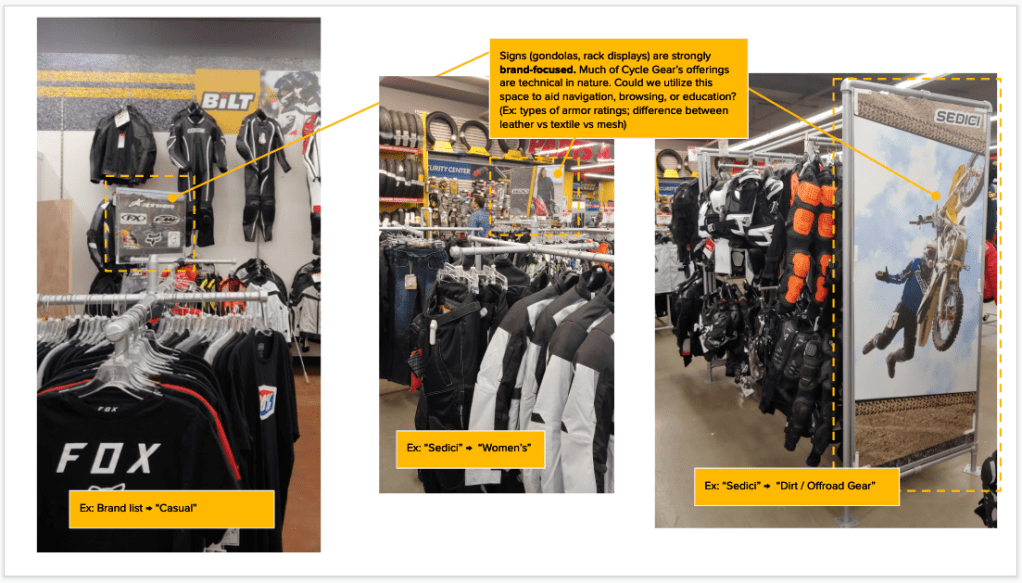

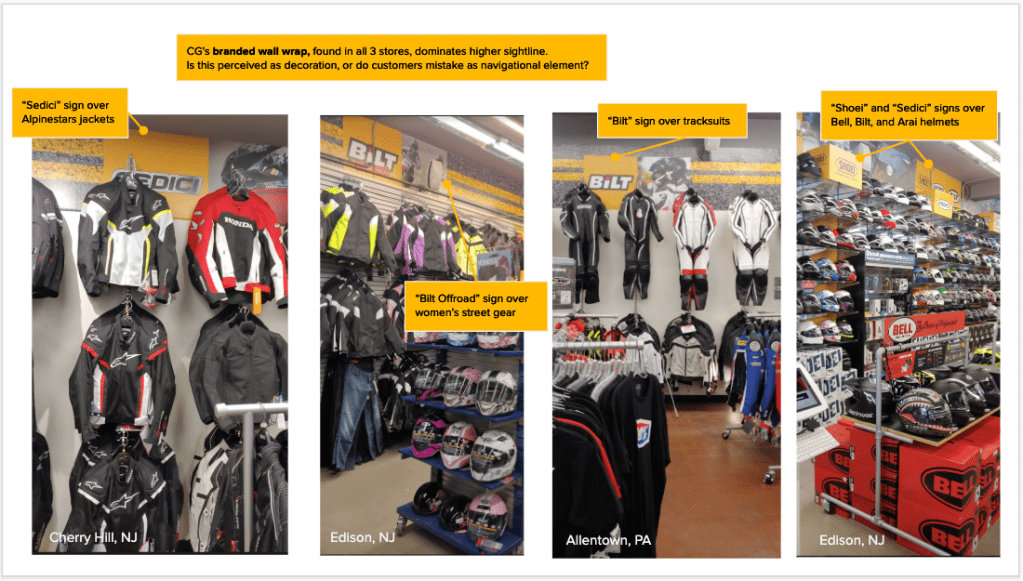

Guided by my literature review, I created an observation guide and headed into the field. I coordinated with regional managers and local staff to visit three store locations in Pennsylvania and New Jersey, spending the day at each store to observe interactions, patterns, and behaviors.

Employee Interviews

As a part of my store visits, I interviewed several employees at each location to gain insider perspective on store management and customer service. The employees’ perspective was vital in collecting qualitative feedback that helped build hypotheses on store location (a major concern), awareness, and common frustrations and pain points of both employees and customers.

Shopper Interviews

During the three store observations, I also interviewed 13 customers as they completed their shopping trips. While this method wasn’t ideal (in the future, I’d plan to do in-person or remote shopalongs), I gained a great deal of insight into reasons for shopping in-store, store loyalty, challenges to shopping online.

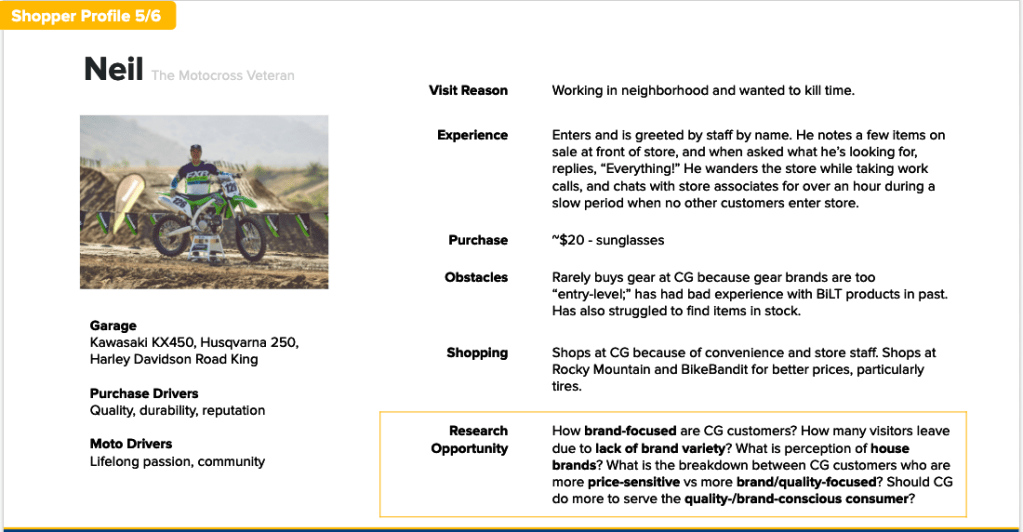

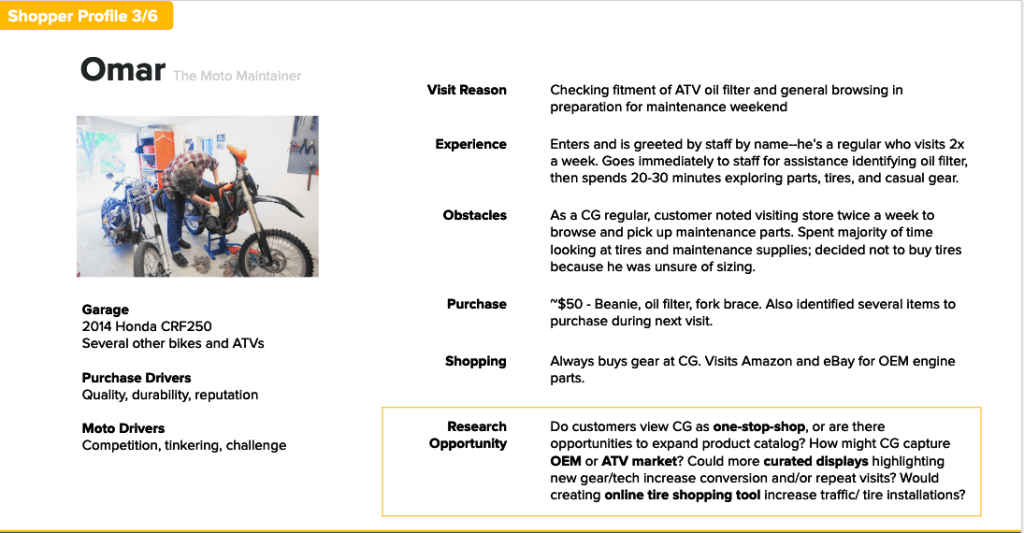

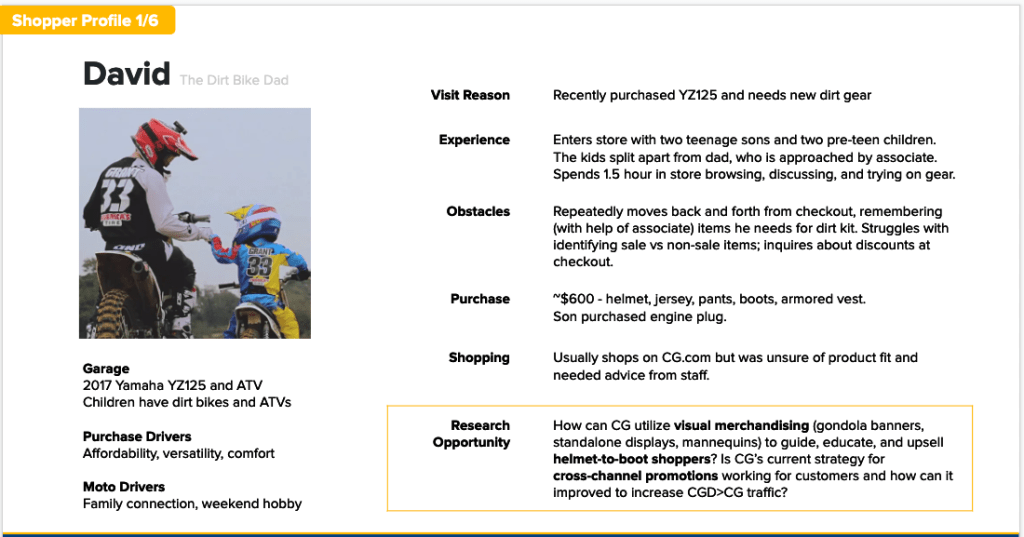

Shopper Profiles

One internal challenge I found in this project was humanizing, and creating empathy for, our sister company’s retail customers. To bring customer voices to the discussion on our retail shoppers, I created a series of “shopper profiles” to summarize different customer interviews. I included pertinent information, such as their motorcycle model, riding frequency, and brand preferences, as well as deeper details such as their reason for purchase, who they shopped for. Because this was foundational research, each profile was associated with further research and business opportunities.

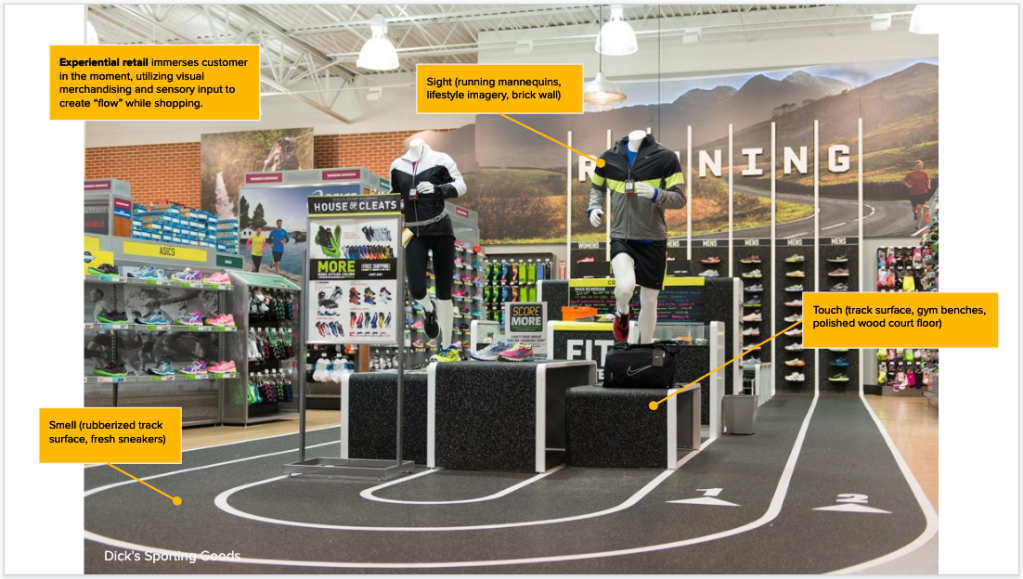

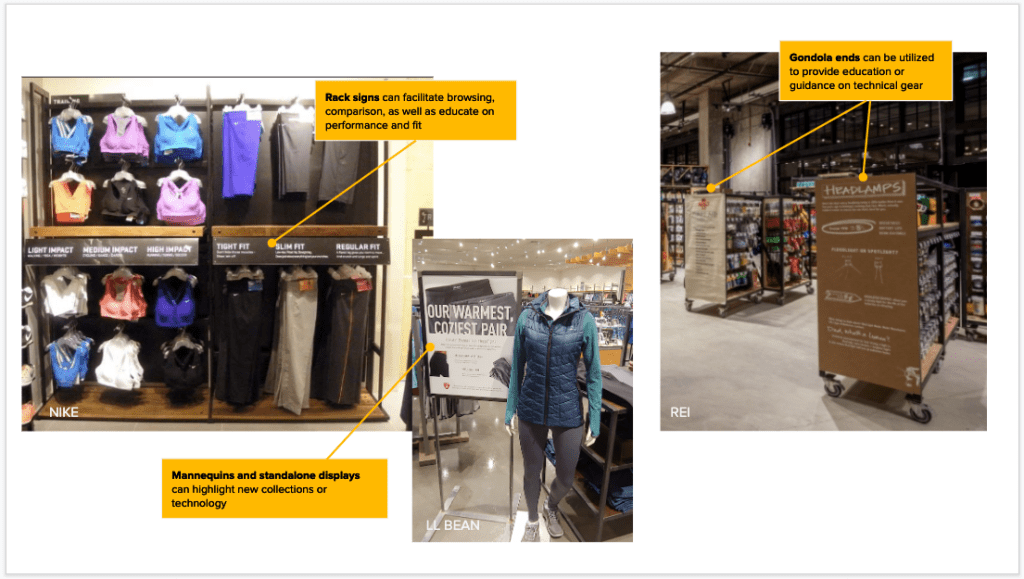

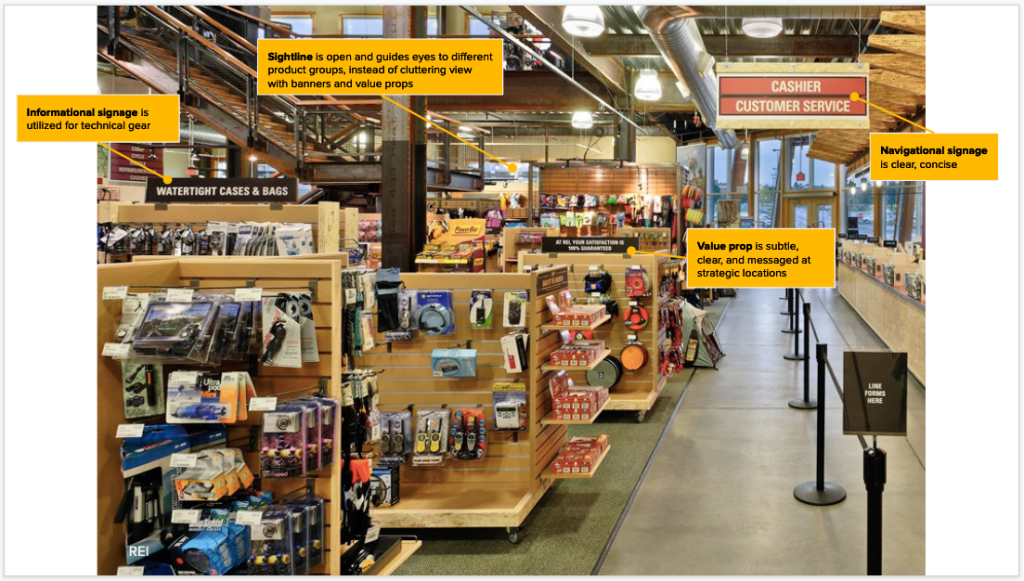

Competitor Evaluation

To generate ideas outside the motorcycle industry but in similar enthusiast markets, I also visited several outdoor and athletic retail stores to better understand an expanding trend in experiential retail.

Dicks Sporting Goods

Athleta, Nike, LL Bean

REI

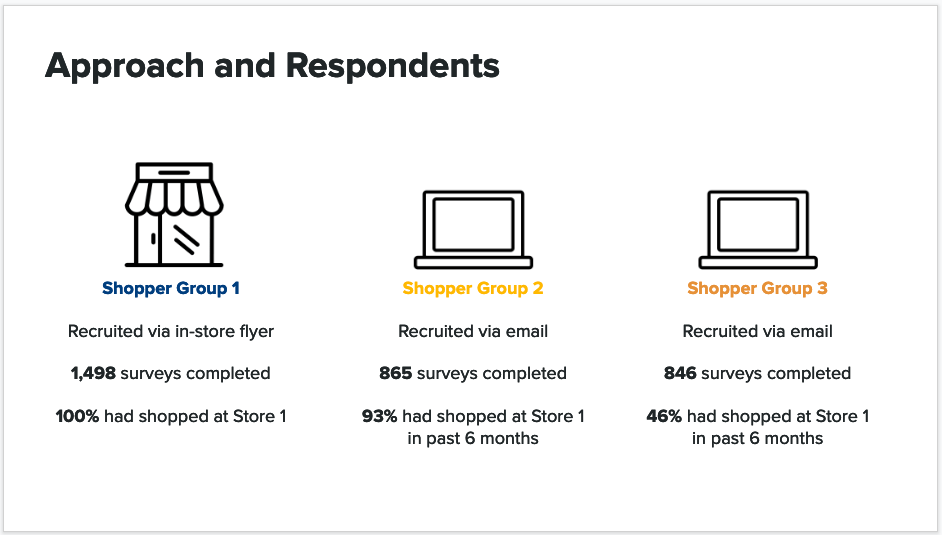

Shopper Survey

After in-store observation and customer interviews, we felt ready to quantitatively evaluate customers’ in-store experiences. We created a survey focused on understanding two key aspects: 1) the most important aspects of the retail experience, and 2) customer satisfaction of those aspects. We collected close to 3,000 completed online surveys across three groups: in-store shoppers who had received a promotional survey flyer, as well as two online shopper cohorts who indicated shopping at a store location in the past year.

Key Findings

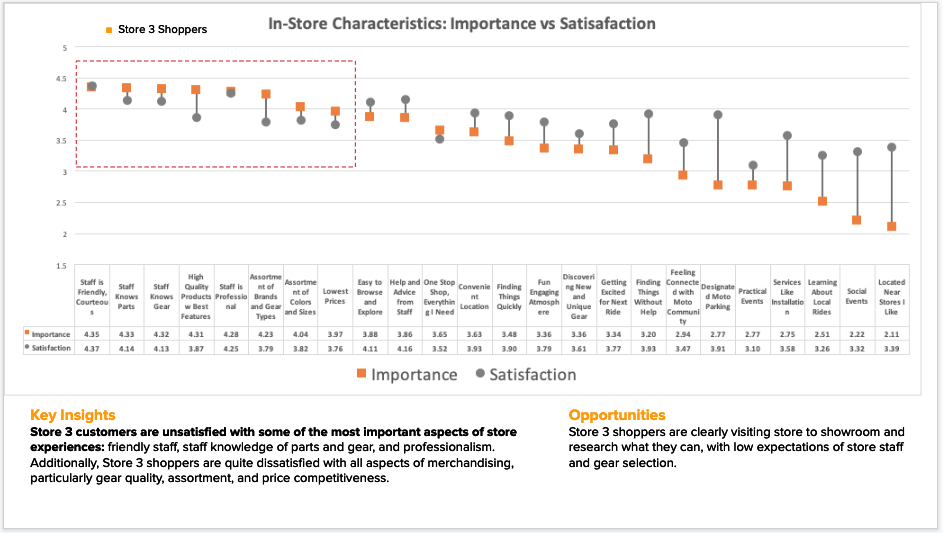

Store staff is the most important aspect of motorcycle gear retail across all shoppers.

One of the most surprising findings was that, despite major differences in the three shopper cohorts surveyed, all of them indicated that store staff–employee professionalism, friendliness, and knowledge of gear and parts–was absolutely pivotal to the retail experience.

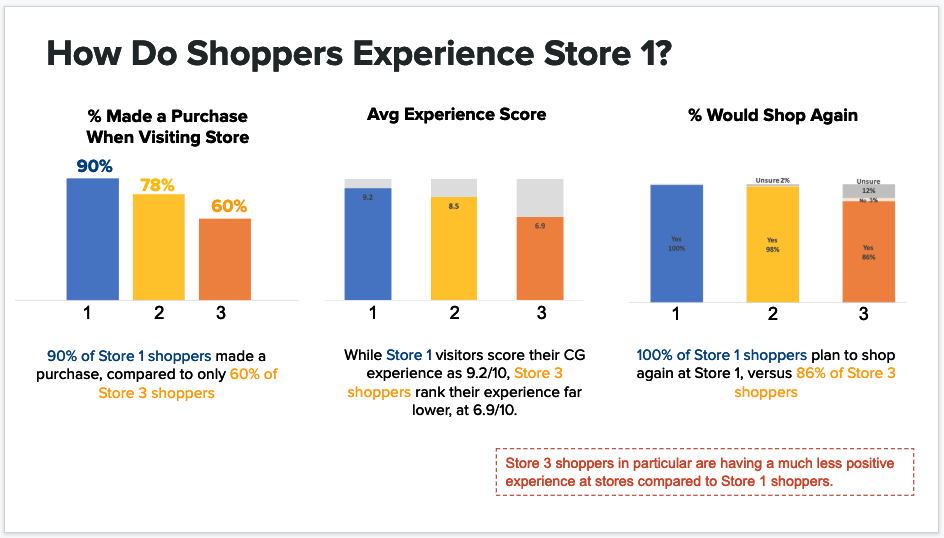

Online shoppings skews expectations.

What found that online shoppers–the group who typically shopped online, but had also shopped in-stores for motorcycle gear–were harsh critics. While the in-store-only shoppers rated every aspect of the retail experience positively, the omnichannel shoppers rated their experiences poorly, and were less likely to have successfully checked out or return.

Risks for omnichannel retailers.

While we found that the omnichannel shopping cohort was often being driven to stores from online sales and website promotions (=good), we also found that omnichannel shoppers were more likely to leave a store due to lack of inventory (=bad). We hypothesized that this is because site inventory is currently different from store inventory, and is potentially misleading to customers.

Research Impact

- Used as a major foundational data set for $200k branding project

- Led to strategy change in store layout updates

- Shifted focus toward elevating, empowering, and celebrating store staff

- Changes to visual merchandising